Staffing

Manging Stress at Work

ISME’s HR Advisor Cait Lynch poses questions And discuss Work-Related Stress, Conflict In The Workplace And Employer Stress with Patricia Murray, Senior Work & Organisational Psychologist With The Health And Safety Authority. Take a look here

Appointing a Lead Worker Representative

The National Return to Work Safely Protocol document sets out the principal and practical steps required in order that employers and employees can keep themselves and their workplaces safe following a return to work. A key piece of this protocol is the requirement for each workplace to appoint at least one Lead Worker Representative. During the COVID-19 crisis some workplaces have remained open and workers have continued to provide services throughout the restrictions. The protocol applies to these workplaces and also to workplaces opening up again in the phased return to work. This guide is designed to aid employers to ensure that they are complying with the protocols relating to selecting, training and supporting their Lead Worker Representative. Read here

Employee Wellness

- ISME’s Employee Wellbeing during COVID-19 Guide looks at a number of areas of wellbeing an employer can use to supports staff available here.

- Information on ISME’s Wellness Programme can be found here

Government Supports

The government has created a National COVID-19 Income Support Scheme. This will provide financial support to Irish workers and companies affected by the crisis.

Employment Wage Subsidy Scheme

Under the EWSS scheme, employers and new firms in sectors impacted by COVID-19 whose turnover has fallen 30% will get a flat-rate subsidy per week based on the number of qualifying employees on the payroll, including seasonal staff and new employees. If an employee has more than one job, each employer can make a claim under the EWSS, ignoring any other employments the employee may have.

- Rates

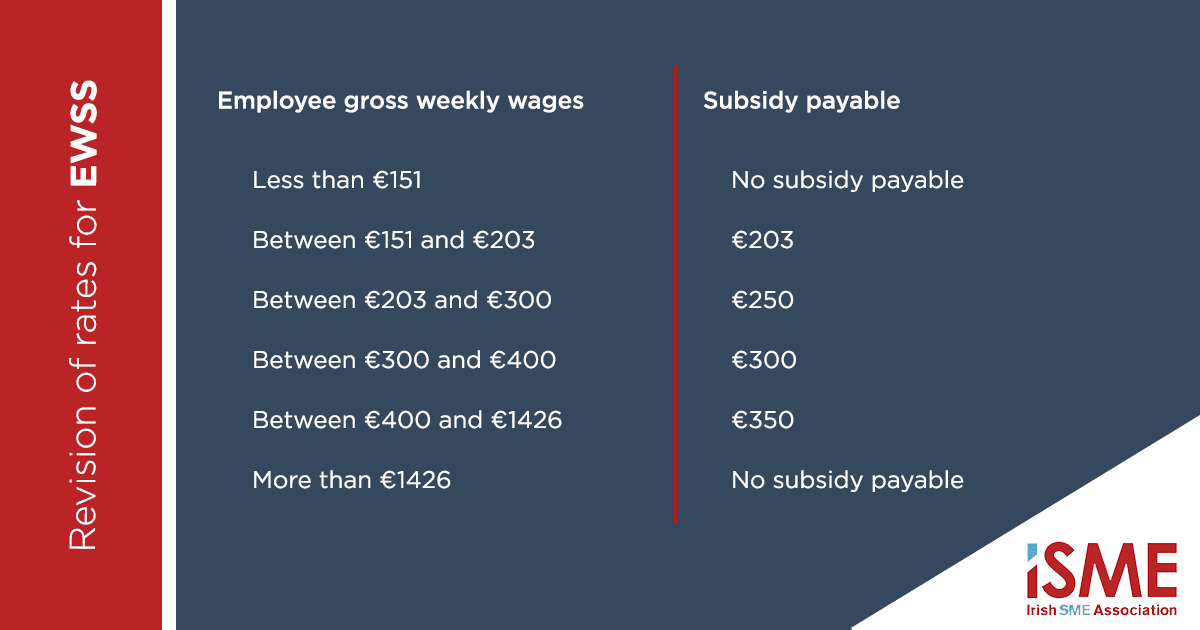

The new scheme is paid at a flat rate that is worked out on the employee’s gross weekly pay. The rate of weekly subsidy the employer will receive per paid eligible employee is as follows:

| Employee Gross Weekly Wage | Subsidy Payable |

| Less than €151.50 | €0 |

| From €151.50 to €202.99 | €203 |

| From €203 to €299.99 | €250 |

| From €300 to €399.99 | €300 |

| From €400 t0 €1,462 | €350 |

| More than €1,462 | €0 |

- How to apply

- Since 18 August, you, your agent or payroll provider will be able to register for the EWSS through Revenue’s Online Service (ROS).

- Applications will only be processed if you

-

- Are registered for Employer’s PAYE/PRSI (PREM)

- Have a bank account linked to the PREM registration

- Have tax clearance

-

-

- Registration will be through the eRegistration system. You will have to make a self-declaration as part of this process. You can get detailed instructions on the process you should follow to operate Revenue’s EWSS on your payroll in Revenue’s EWSS Guidelines (pdf)

ISME have FAQs on the scheme available for Members here

Pandemic Unemployment Payment

From 1 February 2021, the following changes will apply:

- The rate of payment will be reduced from €250 to €203 for people who previously earned between €200 and €300 per week

- The rate of payment will be reduced from €300 to €250 for people who previously earned over €300 per week

The COVID-19 Pandemic Unemployment Payment will end on 1 April 2021. People getting the payment will have to apply for a jobseeker’s payment if they have not found work by that date

ISME have FAQs on the scheme available for Members here

Redundancy

- The emergency suspension of section 12 of the Redundancy Payments Act is also extended until 30th November 2020. This suspends the right of employees to evoke redundancy after four consecutive weeks or six weeks in a period of thirteen of short time or temporary layoff. More information on these announcements can be found here.

- In the unfortunate cases where staff will need to be let go, ISME HR has a number of resources for you in the Members Area such as templates for:

- Redundancy Letter – At Risk

- Template Letter for Redundancy and payment

- Lay Off Notification

- Short Time Notification

- Collective Redundancy

- Protective Notice

You can access these here

ISME have FAQs on the scheme available for Members here

COVID-19 illness payment

- COVID-19 illness payment This payment is for workers and the self-employed who cannot work in the short term because they have been medically certified to self-isolate or are ill due to COVID-19. The application process is the same as Illness Benefit and you will need to be medically certified by your GP. A Certificate of Incapacity for Work or an eCert equivalent is required from your GP. You may not need to attend your GP in person. Please refer to HSE guidelines. The personal rate of Illness Benefit will increase from €203 per week to €350 per week for a maximum of 2 weeks where medically-required to self-isolate or longer following a confirmed diagnosis of COVID-19.Read in full HERE

You can also email or call our HR Support service Monday – Thursday 9.00 -5.30 and Friday 9.00 -5.00

Releases

- FAQ booklet on COVID-19 Income Supports available here

- Government announces new COVID-19 Income Support Scheme

The government has today announced a National COVID-19 Income Support Scheme. This will provide financial support to Irish workers and companies affected by the crisis. Find out more here: - Employer Refund Scheme update on top-ups

There has been an update to the Employer Refund Scheme, allowing employers engaged with the scheme to top up the payment provided by the State. Find out more here: - Minister Doherty announces details of the COVID-19 Employer Refund Scheme. Minister for Employment Affairs and Social Protection, Regina Doherty today announced details of how the government would refund employers who temporarily laid off their employees but are continuing to pay them €203 per week during the current COVID-19 (Coronavirus) situation. Under the arrangement developed with Revenue, employers who have to temporarily lay-off staff and who are not in a position to make any wage payment to them, are asked to keep their employees on the payroll and pay them an amount of €203 – the equivalent of the COVID-19 Support Payment. When they submit payroll returns to Revenue via their payroll provider, Revenue will refund the employer the €203. Read about it here