Financial Support

The government also has a directory of supports available to view here.

-

SBASC – Small Business Assistance Scheme for COVID

-

Applications are open for the new SBASC. This scheme is open to businesses ineligible for CRSS & other sector specific grants. Those whos businesses are down 75% or more in turnover among those expected to benefit. Eligible businesses will receive a payment of €4,000 for Quarter 1 of 2021. There will be a second payment of €4,000 for businesses continuing to meet the criteria. Find out more here

-

- COVID Restrictions Support Scheme

- Read the latest information from Revenue here.

- A new COVID Restrictions Support Scheme (CRSS) has been set up, aimed at businesses impacted by Covid-19 restrictions.Qualifying businesses can apply to Revenue for a cash payment. The maximum weekly payment will be €5,000. The scheme is aimed at those in the accommodation, food and arts, recreation and entertainment sectors. If the Government decides to move to a higher level of restrictions then other sectors may qualify. The scheme will run from 13 October 2020 until 31 March 2021.

- The following measures will apply:

- Payments will be made when Level 3 restrictions or higher are in place in line with the Plan for Living with COVID-19

- Businesses will qualify where government restrictions directly prohibit or restrict customer access to their premises

- Payments will be calculated on the basis of 10% of the first €1 million in turnover and 5% thereafter, based on average VAT exclusive turnover for 2019

- A self- assessment of 80% disruption in turnover will be required

- The following measures will apply:

- Microfiance Ireland

- The COVID-19 Business Loan from Microfinance Ireland is a government initiative to support small businesses through the current challenges and protect job creation and sustainment in Ireland. Business Loans from €5,000 to €25,000. Interest rate of 5.5% APR applies but if you apply through your Local Enterprise Office you can avail of the lower rate of 4.5% APR. There are zero repayments and 0% APR for the first six months and you can apply for a rebate on interest for months 7-12 provided all repayments have been made. Find out more here

- SBCI

- A €200m Strategic Banking Corporation of Ireland (SBCI) Working Capital scheme for eligible businesses impacted by COVID-19. Loans of up to €1.5m will be available at reduced rates, with up to the first €500,000 unsecured. Applications can be made through the SBCI website

- Enterprise Ireland

- A €200m Package for Enterprise Supports including a Rescue and Restructuring Scheme available through Enterprise Ireland for vulnerable but viable firms that need to restructure or transform their business.

- Enterprise Ireland Online Retail Scheme – information available here.

- Sustaining Enterprise Fund for Small Enterprise, information available here.

- Covid-19 Business Financial Planning Grant –providing 100% funding of up to €5,000 to access an approved financial consultant. Find more details here

- The Lean Business Continuity Voucher is available to eligible companies to access up to €2,500 in training or advisory services support related to the continued operation of their businesses during the current pandemic. It is open to small, medium or large client companies of Enterprise Ireland or Údarás na Gaeltachta (including High Potential Start-ups). The voucher may be used to obtain services from approved providers.

- Local Enterprise Office

- The maximum loan available from MicroFinance Ireland will be increased from €25,000 to €50,000 as an immediate measure to specifically deal with exceptional circumstances that micro-enterprises – (sole traders and firms with up to 9 employees) – are facing. Applications can be made through the MFI website or through your local LEO.

- Under the Government’s National Digital Strategy, the expanded Trading Online Voucher Scheme helps small businesses with up to 10 employees to trade more online, boost sales and reach new markets. There is up to €2,500 available through the Local Enterprise Offices with co-funding of 10% from the business. Find out more here

- The new Micro-Enterprise Assistance Fund will help businesses with fewer than 10 employees, which are ineligible for existing grants, with a grant of up to €1,000 to help them adapt and invest to rebuild their business. The fund is administered through Local Enterprise Offices.

- LEAN for Micro is available to Local Enterprise Office clients to help build resilience within small companies. Businesses can avail of consultancy support with a LEAN Expert or help to implement new remote working and physical distancing guidelines. Contact your Local Enterprise Office for further details.

- Credit Guarantee Scheme

- The Credit Guarantee Scheme will be available to COVID-19 impacted firms through the Pillar Banks. Loans of up to €1m will be available at terms of up to 7 years.

- DEBI Supports

- You can read about the steps and supports for SMEs available from the DBEI here.

- The new €250m Restart Grant from DBEI provides direct grant aid to micro and small businesses to help with the costs associated with reopening and reemploying workers following COVID-19 closures. Find out about the Restart Grant Scheme here.

- The Enterprise Support Grant for businesses impacted by COVID-19 is available for eligible self-employed people who close their COVID-19 Pandemic Unemployment Payment on or 18 May 2020. This will provide business owners with a once-off grant of up to €1,000 to restart their business which was closed due to the COVID-19 pandemic.

- A voluntary Code of Conduct between landlords and tenants for commercial rents has been developed based on examples from other jurisdictions and with input from other Departments, State agencies and key stakeholders. The aim of the Code is to facilitate discussions between landlords and tenants impacted by COVID-19.

-

- The Ireland Strategic Investment Fund (ISIF) will make available a new €2 billion fund to support medium and large enterprises in Ireland affected by Covid-19. The new fund, to be known as the Pandemic Stabilisation and Recovery Fund (PSRF), will have €2 billion in total capital and will be made available through a sub-portfolio within ISIF. The PSRF will focus on investment in large and medium enterprises employing more than 250 employees or with annual turnover in excess of €50 million. ISIF may consider investing in enterprises below these levels if they are assessed to be of substantial scale and of significant importance at national or regional level . Find out more here

- InterTrade Ireland

- €2,800 fully funded consultancy support to help businesses develop online sales and eCommerce solutions. Applicants must be indigenous businesses registered in Ireland or Northern Ireland and be active in either manufacturing or tradeable service sectors in the cross border market. Find more details here

- Solas

- Apprenticeship Incentivisation Scheme: Apprenticeship employers are eligible for a €3,000 payment for each new apprentice who is registered between the period 01 March and 31 December 2020. €2,000 per apprentice is payable at the point of registration. A further €1,000 is payable in Quarter 3 2021 for each eligible apprentice retained on their apprenticeship. Find out more here

- IDA

- The COVID Products Scheme will allow for up to €200m in targeted State support to facilitate the research and development of COVID products, to enable the construction or upgrading of testing and upscaling infrastructures that contribute to the development COVID-19 relevant products, as well as to support the production of products needed to respond to the outbreak. The scheme will be delivered through IDA Ireland’s COVID-19 supports

- Facebook

- If you’re business is based in Dublin, Cork and Meath or Clonee where Facebook has offices you are eligible for one of their grants, in a combination of cash and ad credits, to help small businesses You can find more details about the scheme here

Financial support for staff – Read our full section on this here

Employment Wage Subsidy Scheme

Under the EWSS scheme, employers and new firms in sectors impacted by COVID-19 whose turnover has fallen 30% will get a flat-rate subsidy per week based on the number of qualifying employees on the payroll, including seasonal staff and new employees. If an employee has more than one job, each employer can make a claim under the EWSS, ignoring any other employments the employee may have.

Rates

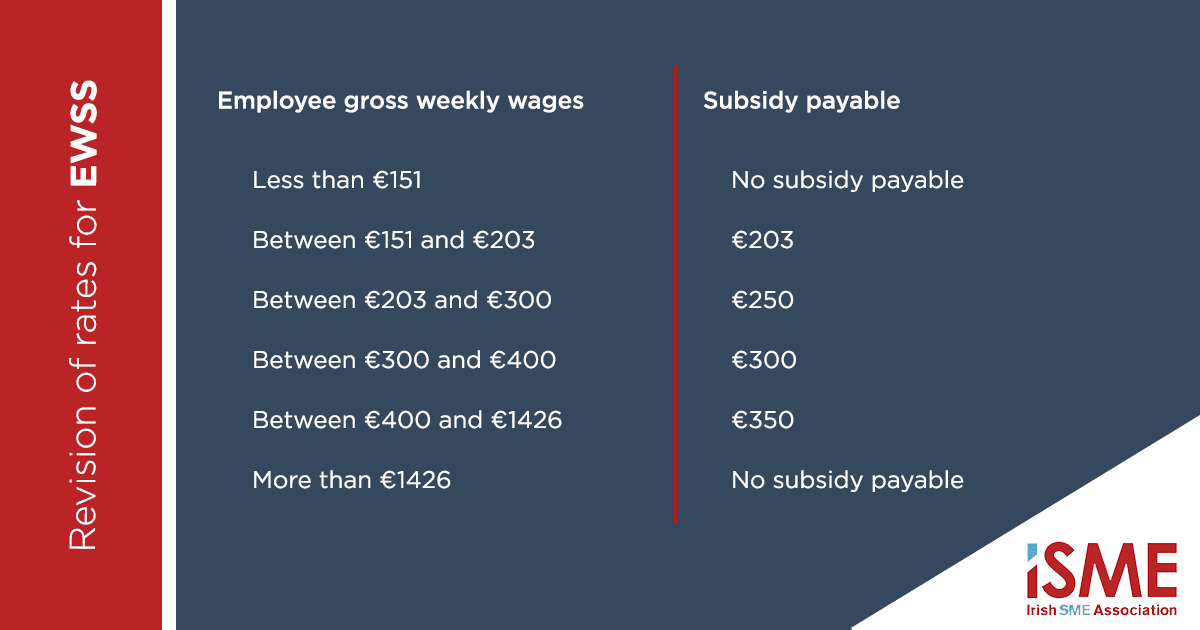

The new scheme is paid at a flat rate that is worked out on the employee’s gross weekly pay. The rate of weekly subsidy the employer will receive per paid eligible employee is as follows:

| Employee Gross Weekly Wage | Subsidy Payable |

| Less than €151.50 | €0 |

| From €151.50 to €202.99 | €203 |

| From €203 to €299.99 | €250 |

| From €300 to €399.99 | €300 |

| From €400 t0 €1,462 | €350 |

| More than €1,462 | €0 |

- How to apply

- Since 18 August, you, your agent or payroll provider will be able to register for the EWSS through Revenue’s Online Service (ROS).

- Applications will only be processed if you

-

- Are registered for Employer’s PAYE/PRSI (PREM)

- Have a bank account linked to the PREM registration

- Have tax clearance

-

-

- Registration will be through the eRegistration system. You will have to make a self-declaration as part of this process. You can get detailed instructions on the process you should follow to operate Revenue’s EWSS on your payroll in Revenue’s EWSS Guidelines (pdf)

ISME have FAQs on the scheme available for Members here

You can also email or call our HR Support service Monday – Thursday 9.00 -5.30 and Friday 9.00 -5.00

Insurance

- Alliance for Insurance Reform have a special update with useful information for all dealing with insurance in the COVID-19 environment.

Energy Saving

- The government has announced there will be a payment holiday for energy in shuttered non-essential SMEs. Read in full here

Releases

- Government announces new COVID-19 Income Support Scheme

The government has today announced a National COVID-19 Income Support Scheme. This will provide financial support to Irish workers and companies affected by the crisis. Find out more here: - Employer Refund Scheme update on top-ups

There has been an update to the Employer Refund Scheme, allowing employers engaged with the scheme to top up the payment provided by the State. Find out more here: - Commercial Rates

Support for businesses impacted by COVID 19 through commercial rates deferral. Read here - Refunding Employers

Minister for Employment Affairs and Social Protection, Regina Doherty today announced details of how the government would refund employers who temporarily laid off their employees but are continuing to pay them €203 per week during the current COVID-19 (Coronavirus) situation.

Under the arrangement developed with Revenue, employers who have to temporarily lay-off staff and who are not in a position to make any wage payment to them, are asked to keep their employees on the payroll and pay them an amount of €203 – the equivalent of the COVID-19 Support Payment. When they submit payroll returns to Revenue via their payroll provider, Revenue will refund the employer the €203. Read about it here