The European Commission announced on 28 June 2021 that e-commerce taxation rules will change. The new VAT rules for online shopping are in force on 1st July 2021 in order to both simplify cross-border e-commerce and ensure greater transparency for EU cross-border shoppers when it comes to pricing and consumer choice.

The new rules will apply to all below outside the EU/EEA:

- online sellers

- online marketplaces/platforms

- postal operators and couriers involved in online deliveries

- customs and tax administrations applying the tax regimes for online purchases

- individual consumers i.e., customers shopping online

In brief, the changes are:

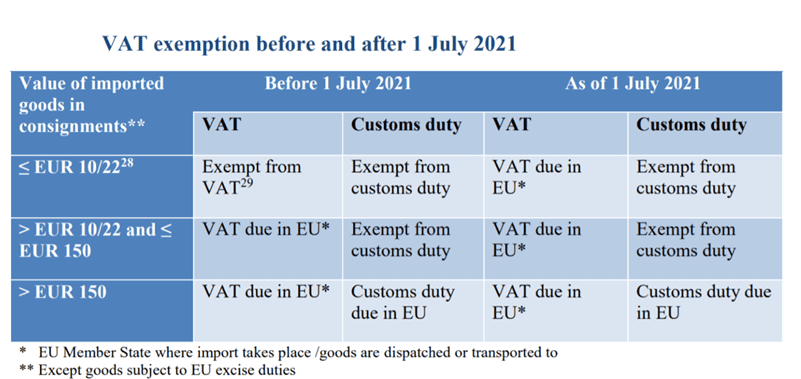

- VAT is now charged on all goods entering/imported into the EU from non-EU countries, irrespective of value.

- All e-commerce sellers based within or outside the EU/EEA, selling directly to consumers or via online marketplaces, need to have an EU VAT registration and pay VAT for all of their EU sales.

Source: EUROPEAN COMMISSION DIRECTORATE-GENERAL TAXATION AND CUSTOMS UNION – Indirect Taxation and Tax administration Value Added Tax – Explanatory Notes on VAT e-commerce rules. Published September 2020

For consumers, this means that VAT will feature as part of the total price paid directly to the seller, at the time of purchase and, therefore, not at destination, to customs authorities or courier services. In its communication, the Commission warns that, ‘If the supplier is not VAT-registered, you will need to pay the VAT and possibly some clearance fees charged by the transporter of the goods when goods are imported in the EU.’ It is believed that paying the VAT at source will also reduce fraud and improve the online consumer experience for online shoppers in the EU.