Today is Budget 2021,

ISME Pre-Budget (submitted in July) is available here: Obviously things have moved on somewhat, but our asks remain the same. Follow our coverage below for LIVE updates from 1. Our panel today will be made up of: Neil McDonnell – ISME CEO, Ross McCarthy- ISME Chairman, Eilis Quinlan – Quinlan Accounts, Jamie O’Hanlon – Avid Partners

18.00 Listen Back to Neil on The Last Word with Matt Cooper

LISTEN BACK: What does #Budget2021 mean for you? @ianguider, Neil McDonnell of @isme_ie, Norah Collender of @CharteredAccIrl and @adriancummins join us to discuss.https://t.co/9tHJikG4Ux

— The Last Word (@lstwrd) October 13, 2020

16.16 Message from the ISME CEO

“ISME broadly welcomes today’s budget in which there are a number of measures designed to keep businesses and their employees going. It is essential that these measures are introduced because of the scale of damage endured by thousands of businesses in Ireland. The two assumptions of no vaccine in the short term and a no-deal Brexit are the correct ones to build the budget around, with supports announced well into 2021. We note and welcome the significant spend on health, and hope that some of this can be invested urgently by the introduction of a fit for purpose testing regime, that will assist in keeping the virus at the lower Phase 1 and Phase 2 levels. Crucially, this will give more businesses a chance at recovery. The support measures introduced in the wider hospitality sector along with a reduction in Vat to 9% are to be broadly welcomed, although at this stage, they are small consolation for many in the sector. The increase in the earned income credit to €1,650 is a long-overdue but welcome adjustment, which brings the self-employed tax credit in line with the PAYE sector.”

15.45 ISME CEO and Chairperson speak to the media

ISME CEO, Neil McDonnell will be joining @cooper_m after 4.30 on @lstwrd to discuss #budget21 LIVE on @TodayFM pic.twitter.com/m6tCvV7MSi

— ISME (@isme_ie) October 13, 2020

————————————————

ISME Chairman @rosspmccarthy will be joining @kierancuddihy after 4 to discuss #Budget2021 and what it means for SMEs. #budget21 pic.twitter.com/j0JkDbGOhw

— ISME (@isme_ie) October 13, 2020

15.15 ISME CEO Shares his thoughts

- This is a big spending packet and a big budget roughly €17 billion gross.

- The government is also going to dip into the rainy-day fund of 1.6billion.

- We welcome the final increase of the earned income credit to €1650 which brings equity with PAYE workers.

- There are some minor adjustments to the Capital Gains Tax regime.

- We welcome the CRS scheme for closed business which will give them up to €5,000 a week based on their 2019 turnover where they demonstrate that turnover has been reduced by 80% but we do need to see the T&CS.

- We also welcome the changes to the EWSS and that there is no longer a cliff edge at the end of March 2021 – instead it will continue onto the end of December 2021.

- National Debt will increase under this budget from €203bn to €219bn which is 108% of gross national income.

- The forecast for growth for Ireland has been decreased to 1.75%.

- We welcome a commitment to increase capital expenditure to €10bn in 2021.

- Carbon Tax will increase by €7.50 per tonne every year to give €100 per tonne charge by 2030.

- The help to buy scheme is expanded into 2021 – good news for home buyers.

- We welcome the reduction in VAT from 13.5-9% however we believe the temporary reduction in the 23% vat rate should be made permanent.

- We do see a missed opportunity on property tax. If it had been reformed it could have bought in an extra €20million and if CGT was reformed by being brought down to approx. 25% we could have seen an extra €100million.

14.10

- Minister McGrath promises €500 million to “facilitate the construction of 9,500 new social housing units in 2021.

14.05

#Budget2021 Earned income credit for self employed FINALLY lifted to €1,650!

— ISME (@isme_ie) October 13, 2020

- Earned income credit for self employed FINALLY lifted to €1,650!

- Earned income credit for the self employed increased to €1,650 from €1,500 so it is now the same as the PAYE credit #Budget2021

- Capital Gains Tax – The government are reducing the qualifying period of business ownership from 5 years to 3 years

- €4bn increase in health spend for 2021

- €340m in Brexit expenditure- compliance and checks

- 12.5% corporation tax rate maintained, we will work to the BEPS agenda

- €17bn spending increase on the way

- Further rates waiver worth €300m on the way

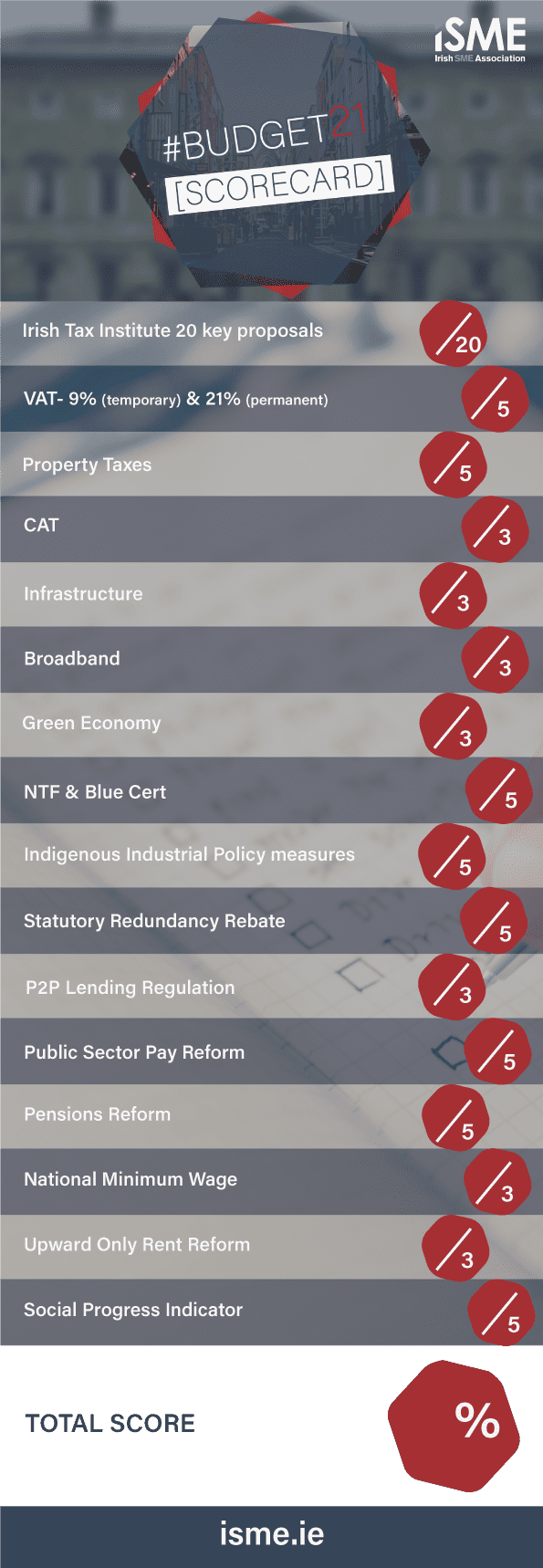

12.30: Scorecard Released

ISME Launch their scorecard. Each category will be graded based on how the budget is addressing the points from an SME’s perspective

Join us today on twitter for #Budget2021 commentary with

????Neil McDonnell – ISME CEO

????@rosspmccarthy– ISME Chairman

????Eilis Quinlan – @QuinlanAccounts

????Jamie O’Hanlon – @AvidPartners#Budget21 #irishbusiness #irishsme pic.twitter.com/UpO8HwKeYi— ISME (@isme_ie) October 13, 2020

Our key pandemic issues were and continue to be:

- Adequate liquidity provision for SMEs.

- A clear plan to restart the economy

- Access to an affordable examinership regime for SMEs