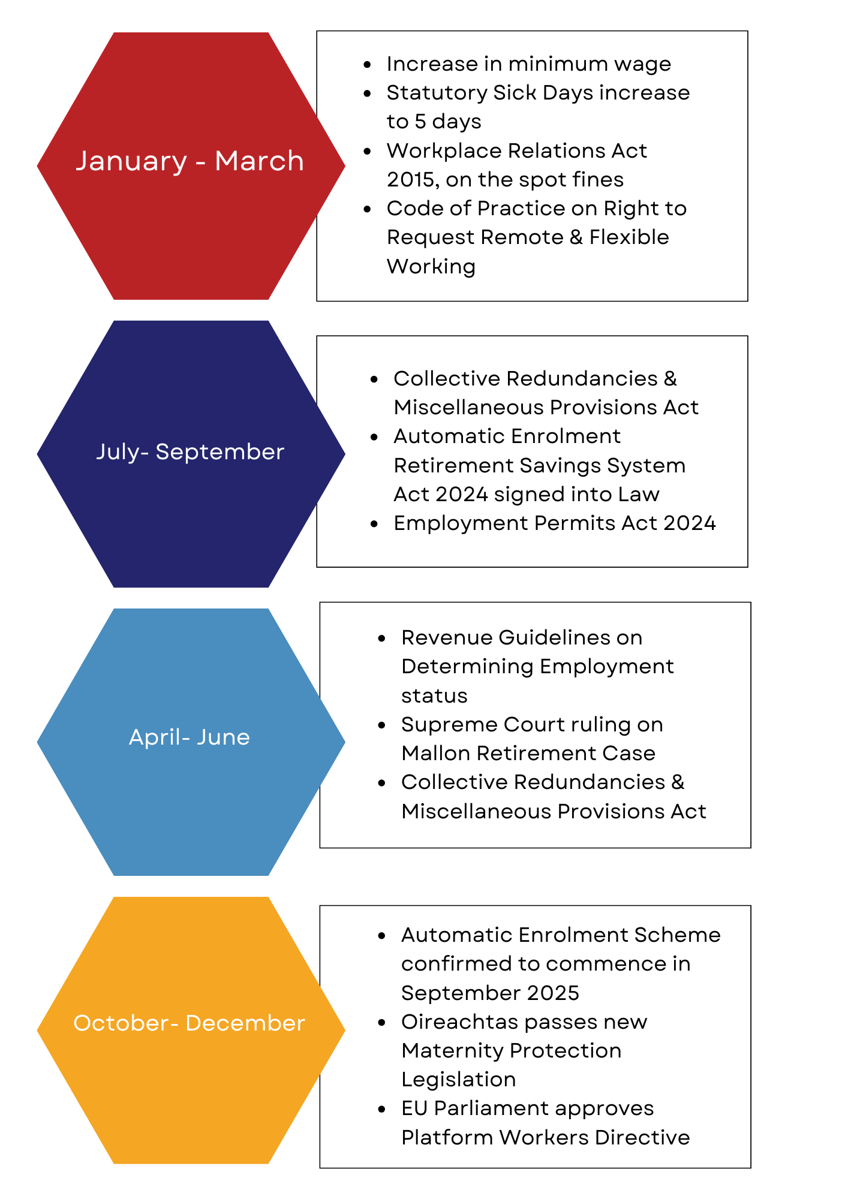

As with recent years in the Employment Law sphere, 2024 saw a number of changes in Ireland with many regulatory updates coming into effect as illustrated in the below image:

While each change outlined in the above has a great impact on the day to day operations of your business, below is a deep dive into some of the more pertinent legislative updates that we would advise are included in your end of year review process.

On the Spot Fines:

January saw the introduction of the Workplong-awaitedons Act 2015 (Fixed Payment Notice) Regulations 2023 (the “Regulations”) providing WRC Inspectors with the power to issue on the spot fines up to €2000 for a number of factors. Notably:

- €2,000 – Employer fails in a collective redundancy situation to consult with employees’ representatives and to provide them with mandatory specified information.

- €1500 – Employer failure to issue Terms of employment to Employee within 1 month

- €500 – Employer does not display a ‘tips and gratuities notice’ or a ‘contract Workers Tips and Gratuities Notice’.

Work Life Balance – Code of Practice on Right to Request Remote and Flexible Working:

March 2024 saw the introduction of the Code of Practice on the Right to Request Remote and Flexible Working. This long awaited code outlines in great detail the role of the Employer, the Employee along with Health and Safety and Working Arrangements requirements. It is an excellent tool to use once a request for remote or hybrid working has been received. In addition, there are forms that can be used by all businesses.

In summary, when an employee submits a request to a flexible or remote working arrangement, the employer should ensure that:

- Written decision is provided to the employee within 4 weeks of submitting their request; or advise employee if there is a need to extend for further 4 weeks

- Employer gives fair consideration to the Business and Employee needs

- Provide reasons why it is or is not viable at this time in writing to the Employee

oIf declining the request, consider providing a reasonable timeframe when can be reviewed again – while this is not a legislative requirement, it certainly eases the message if not approving the request at the time.

- Where an agreement has been reached, it will likely effect the terms of the employees Contract of Employment. The Employer should draft up a contract amendment letter with both parties signing off on the agreement

- The WRC heard it’s first case under this legislation in the case of Alina Karabko vs TiktokTechnology Ltd; the full case can be read here: Alina Karabko vs Tiktok Technology Ltd

Guidelines for Determining Employment Status for Taxation Purposes

Following from the Supreme Court ruling in the case of The Revenue Commissioners v. Karshan (Midlands) Ltd t/a Dominio’s Pizza, Revenue have recently published its “Guidelines for Determining Employment Status for Taxation Purposes”.

This allowed for employers to make an informed decision to determine if someone is Self Employed or an Employee.

The five-step framework is outlined in here provides for 5 questions on the Decision Making

Pension Auto-Enrolment Scheme

Budget 2025 confirmed the commencement of Auto Enrolment Scheme will commence in on 30th September 2025.

The Government have prepared papers on Auto-enrolment Retirement Savings System for Employees and Employers along with a Q&A document; these documents can be found here.

As the table above identifies, there are continuous legislative changes impacting on Employers and Employees in Ireland.

_______________________________

In October 2024, Employment Law expert Katherine McVeigh, Barrister-at-Law, hosted a 2024 Employment Law Update providing exceptional insights Mandatory Retirement Age, Self Employment v Employee, Statutory Sick Pay and some fantastic insights in 2024 judgements from the WRC and beyond.

This webinar can be viewed using the link below at a cost of € 65 for non-members plus a 10% discount code for members. https://isme.ie/watch-back-your-2024-employment-law-update/

As always, if you require any support with HR or Employment Law you can contact the ISME HR Team on 01 6622755 Option 2 or via HR@ISME.ie. Members also have access to a full suite of HR templates regarding Absence management on the ISME HR Hub

2025 will undoubtedly bring more changes from both an EU and national perspective.

This will be outlined in the next ISME publication.