Finance

Banking Advice:

ISME have a Code of Conduct for business lending to SMEs including Do’s and Don’ts. Members can view the full details here

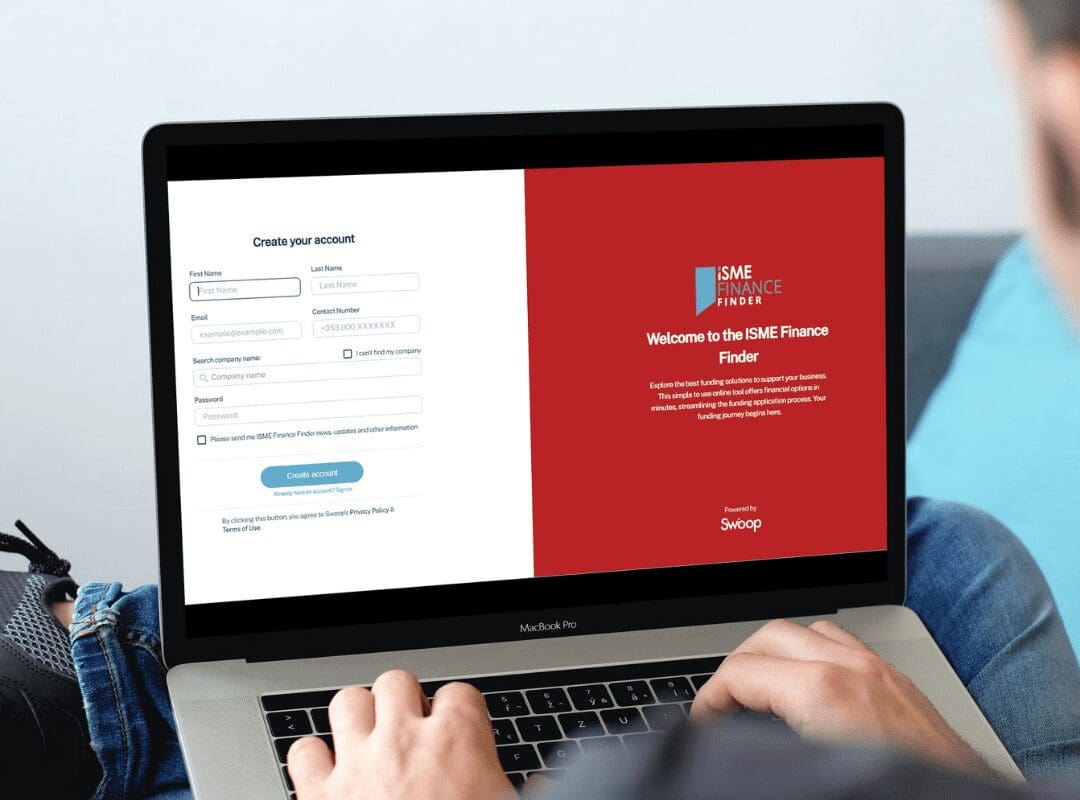

ISME Finance Finder

ISME in partnership with Swoop Funding launched in May 2022 the ISME Finance Finder – a one-stop-shop for funding solutions for Irish SMEs. This partnership is the first of its kind in Ireland and utilises Swoop technology to offer loan options to SMEs in minutes, streamlining the funding application process and providing funding options for businesses within minutes. For a start-up or a business looking to expand, improve cashflow, refinance debt, acquire a business, purchase property, stock or invest in a new market, the ISME Finance Finder will provide easy access to the funding opportunities available to them. The platform can also be used to secure funding for big ticket items such as vehicles, buildings, and equipment through the Asset Finance option. The online portal is open to all businesses across Ireland.

In addition to access to funding tailored for their specific business needs, users of the Finance Finder will also enjoy:

- Access 5 days a week to the ISME Finance Finder hotline and email from 9.00am to 5.00pm, providing guidance on funding queries

- Access to a team who can answer your queries and guide your application

- Templates and tools on the dashboard to aid your application

- Finance updates and alerts

The funding journey for Irish business starts now by going to https://isme.ie/finance-finder/

Strategic Banking Corporation of Ireland (SBCI).

Flexible finance for Irish SMEs

The SBCI’s goal is to ensure access to flexible funding for Irish SMEs by facilitating the provision of:

- Flexible products with longer maturity and capital repayment flexibility, subject to credit approval;

- Lower cost funding to financial institutions which is passed on to SMEs;

- Market access for new entrants to the SME lending market, creating real competition.

How will the funds get from the SBCI to my business?

- The funding will be made available to SMEs through both bank and non-bank specialist on-lenders.

- The release of long-term funds by promotional (or state-backed) financial institutions, through frontline (or traditional) finance providers, is a successful and effective model for funding SMEs throughout Europe.

- The SBCI is currently working with non-bank financial institutions (such as leasing and invoice discounting providers) to develop alternative products for the Irish SME sector in order to deliver choice and competition.

The products include

- Invoice Financing

- Leasing & Hire Purchase

Find out more go to SBCI.

Microfinance Ireland

Finance for small businesses with no more than 10 employees

Microfinance Ireland provides loans to small businesses with no more than 10 employees, including sole traders and start-ups. The loans of between €2,000 and €25,000 are for commercially viable proposals. Since September 2015, under the Microenterprise Loan Fund Scheme 2015, there is no longer a requirement to have been refused credit by the banks. Forms and details of how to apply are available here.

Credit Review Office

If you have a small or medium business and your application for credit is refused by one of the participating banks you may apply to the Credit Review Office to have your case reviewed. To be eligible for a review your application must have been in writing. The fee for the review ranges from €100 up to a maximum of €250.

The Credit Guarantee Scheme aims to encourage additional lending to small and medium businesses who are commercially viable but have difficulty in accessing credit. Under the Scheme eligible applicants will be assisted in obtaining a loan and in establishing a favourable credit history. You can find out more in the information booklet about the Scheme. There are also Customer Frequently Asked Questions and eligibility criteria. Since 3 March 2017, changes to the Credit Guarantee Scheme extend the definition of loan agreements to include certain non-credit products such as overdrafts. The scope of the scheme also extends to cover other financial product providers for example lessors.

Find out more about the Credit Review Office here.

Energy Supports

The Department of Enterprise, Trade and Employment’s Budget package is designed to help businesses of all sizes with their rising energy costs and to make them more sustainable through longer and medium-term investments.

This support is being delivered through five new targeted energy supports schemes:

Businesses may be eligible for more than one scheme.

While the schemes are currently in development, you’ll find more detail below about their eligibility criteria and how they will be administered. The schemes will be publicised when they are open for applications in the coming months.

Direct supports

€1.25 billion Temporary Business Energy Support Scheme (TBESS)

The Temporary Business Energy Support Scheme (TBESS) (revenue.ie) will assist businesses with their electricity or natural gas (energy) costs during the winter months. The scheme will be open to businesses that:

- are tax compliant

- carry on a Case I trade or Case II profession (including certain charities and approved sporting bodies in relation to certain income)

and - have experienced a significant increase of 50% or more in their natural gas and electricity average unit price between the relevant bill period in 2022 and the corresponding reference period in 2021

Revenue will administer the scheme, which is being designed to be compliant with the European Union (EU) State Aid Temporary Crisis Framework. This means that EU Commission approval will be required for the scheme before any payments can be made to businesses.

Information on the scheme is available from Revenue. More detailed information will be published in the coming weeks, including on how businesses can submit claims via an online portal.

€200 million Ukraine Enterprise Crisis Scheme

There will be two streams of funding under the Scheme to assist viable but vulnerable firms of all sizes in the manufacturing and internationally traded services sectors. The first stream will assist firms suffering liquidity problems as a result of Russia’s war on Ukraine, and the second stream will also help those impacted by severe rises in energy costs. View details on Ukraine Enterprise Crisis Scheme.

Small Firms Investment in Energy Efficiency Scheme

The Small Firms Investment in Energy Efficiency Scheme will provide a grant through the Local Enterprise Office (LEO) network to companies to encourage investment in energy efficiency technologies or processes that reduce carbon emissions and overall energy costs. The scheme will follow on from the LEO Green for Micro Scheme which currently provides advice and technical support to firms on energy efficiency and reducing their carbon footprint. The new scheme will open in 2023 and will be administered by the Local Enterprise Offices.

Loans

€1.2 billion Ukraine Credit Guarantee Scheme

The State-backed Ukraine Credit Guarantee Scheme will provide low-cost working capital or medium-term investment, especially in energy saving measures to SMEs, primary producers and small mid-caps (businesses with fewer than 500 employees). Loans of up to 6 years will be available, from €10,000 to €1 million, with no collateral required for loans up to €250,000. The scheme will be operated by the Strategic Banking Corporation of Ireland (SBCI) and loans will be provided by finance providers from the private sector including banks, non-banks and credit unions.

€500 million Growth and Sustainability Loan Scheme

The Growth and Sustainability Loan Scheme (GSLS) will make up to €500 million in low-cost investment loans of up to 10 years available to SMEs, including farmers and fishers and small mid-caps, with no collateral required for loans up to €500,000. A minimum of 30% of the lending volume will be targeted towards environmental sustainability. 70% of lending will be for strategic investments with a view to increasing productivity and competitiveness and thus underpinning future business sustainability and growth. The scheme will be operated by the SBCI and participating finance providers. It is anticipated that it will be launched in the market in the first half of 2023.

For full details on supports for SMEs click here.

Small Companies Administrative Rescue Process (SCARP)

The SCARP scheme was introduced by The Companies (Rescue Process for Small and Micro Companies) Act 2021 to give help to certain companies who are viable, yet Insolvent. The scheme applies to small and micro companies and: allows companies to restructure their debts. helps companies avoid liquidatio

Details are available from Revenue here.

Find out more about how SCARP works in a recent presentation at ISME Roadshows by solicitor Barry Lyons here.

Department of Enterprise, Trade & Employment

Supporting businesses to start, scale and innovate

The department provides a range of tailored supports for enterprise of all sizes in Ireland. Supports include access to finance, management development, mentoring supports, business development programmes, market supports and trade promotion. Visit https://supportingsmes.gov.ie/

Enterprise Ireland

Enterprise Ireland is the state agency responsible for supporting the development of manufacturing and internationally traded services companies. They provide funding and supports for companies – from entrepreneurs with business propositions for a high potential start-up through to large companies expanding their activities, improving efficiency and growing international sales. Their funding supports include:

- Business Financial Planning Grants

- Sustaining Enterprise Fund

- Green Transition Fund

- Online Retail Scheme

- Accelerated Recovery Fund

- Covid-19 Products Scheme

- Digital Transition Fund

- Evolve Strategic Planning grant

- R&D Funding including Innovation Vouchers

Find our more go to https://www.enterprise-ireland.com/en/funding-supports/ and https://www.enterprise-ireland.com/en/Research-Innovation/Companies/R-D-Funding/

Finance for Tourism

This online guide highlights the wide range of funding programmes financed by the new budget, multiannual financial framework 2021-2027, and Next Generation EU. It contains links to relevant EU programme websites with the latest developments (such as annual work programmes or calls for proposals) and further details per programme.. Find out more here.

JobsPlus

JobsPlus is an employer incentive which encourages and rewards employers who employ jobseekers on the Live Register. JobsPlus has replaced the Revenue Job Assist and Employer Job (PRSI) Exemption Schemes.

Under the Trading Online Voucher Scheme vouchers of up to €2,500 may be available to businesses who demonstrate that they have a credible plan for trading online. Further details are available from your Local Enterprise Office or click here.

Sustainable Energy Authority of Ireland (SEAI)

Energy finance & grants for SMEs

The SEAI are working with people across Ireland, from homeowners to large industry, to transform how they think about and use energy. They provide grants and funding to business as follows:

- Accelerated Capital Allowance

- Communities Grant

- Electric Vehicles Grant – Commercial

- Energy Efficiency Obligation Scheme

- Excellence in Energy Efficient Design (EXEED)

- Support Scheme for Energy Audits

- Support Scheme for Renewable Heat

- Research, Development & Demonstration Funding Programme

Find our more here.

Bodies that award grants to small businesses in Ireland include:

- Department of Business, Innovation and Skills

- The Technology Strategy Board

- Department for Education

- Department of Transport

- Department for Communities and Local Government

- Department for Environment, Food and Rural Affairs

- Department of Enterprise, Trade and Investment – Northern Ireland

- Enterprise Ireland

Chartered Accountants Voluntary Advice

If you are having difficulties with your creditors the Chartered Accountants Voluntary Advice service – CAVA can give free advice and assistance on your business affairs. Contact your local Citizens Information Service or Money Advice and Budgeting Service (MABS) to see if they offer the service.

More Finance advice from ISME

Get more Finance Support information here.

Revenue Audit: A Revenue audit is an examination of the information and figures shown by a taxpayer in their tax returns against those shown in their business records. Find out more in the guide here