COVID-19 timeline

February 2022

- 21st February: Government announces that most of the public health measures currently in place can be removed, view details here.

- 2nd February: The HSA has produced a COVID-19 Response Plan template and Good Practice checklists available here. They have been prepared to help employers, business owners and managers to continue running their workplaces safely, and to help workers, in particular the Lead Worker Representative understand what they need to do to help prevent the spread of COVID-19 in the workplace.The template and checklists have been drafted, based on the Government’s advice and the Transitional Protocol – Good Practice Guidance for Continuing to Prevent the Spread of COVID-19

January 2022

- 31st January: The Transitional Protocol, setting out best practice to help employers and their employees return to work safely, was published today. Find out more here.

- 21st January: The Redundancy Payments (Amendment) Bill published today, which gives employees who have lost out on reckonable service while they were on lay-off due to COVID-19 restrictions, and have subsequently been made redundant, a special payment of up to a maximum payment of €1860 tax-free to bridge the gap in their redundancy entitlements. Find out more here.

19th January: Government announces COVID recognition payment and a new public holiday, find our more here. - 14th January A refreshed Work Safely Protocol has been published to reflect recent changes in Public Health advice, view here.

- 5th January: Update on payments awarded for COVID Pandemic Unemployment Payment and Enhanced Illness Benefit is available here.

December 2021

- 6th December: Minister Humphreys announces details on the re-opening of PUP to workers impacted by the latest restrictions, find out more here.

November 2021

- Read our updated guide on The Work Christmas Party and COVID considerations 2021 here.

October 2021

- The Labour Employer Economic Forum (LEEF) published an updated Guidance note on 20th October designed to assist employers and workers to plan for the phased return to the workplace. A technical update of the Work Safely Protocol has been prepared with some minor changes to reflect both the most up-to-date Public Health advice as well as the LEEF Guidance note. This updated Protocol remains applicable to all sectors of the economy. It sets out the minimum Public Health infection prevention and control measures required in every place of work to prevent and reduce the spread of COVID-19 following temporary closures and in the ongoing safe operation of workplaces.

September 2021

- The Government’s COVID-19 national protocol for employers and workers, the Work Safely Protocol, was updated on 16 September 2021 to reflect updated Public Health advice and knowledge. These minor technical updates include the inclusion of new symptoms associated with the Delta variant of COVID-19 and additional information on ventilation and vaccinations. This follows Government publication on 31 August of ‘Reframing the Challenge, Continuing our Recovery and Reconnecting‘ which sets out the national approach to the further reopening of society from 20 September 2021 in advance of a further planned relaxation of restrictions from 22 October 2021.A key element of ‘Reframing the Challenge, Continuing our Recovery and Reconnecting’, is the facilitation of a phased and staggered return to the workplace for specific business requirements with effect from 20 September.

- Given the importance of keeping workplaces safe during the COVID-19 pandemic, the Labour Employer Economic Forum (LEEF) established a consultative stakeholder group to oversee the implementation of the Work Safely Protocol. This consultative group published a Returning Safely to the Workplace from 20 September Guidance Note to assist employers and workers to plan for the phased return to the workplace.

- The HSA has published four additional COVID-19 checklists on: Ventilation (Checklist No.8), Returning to the Office (Checklist No.9), and Rapid Antigen Diagnostic Tests (Checklists No.10 and 10a) to help employers, managers and workers plan their return to the workplace safely. The Returning to the Office checklist should form the basis for discussion between employers and employees, with the support of Lead Worker Representatives, to ensure that all practical steps are taken to prevent the spread of COVID-19 in the workplace. The full range of updated HSA COVID-19 checklists, templates and posters can be found here.

August 2021

- Ireland’s plan for the next and final phase of COVID-19. More information here

July 2021

- 23rd July: Publication of guidance for reopening of indoor hospitality, details here or in Fáilte Ireland’s Operational Guidelines here.

- HSA publishes Checklist on Ventilation

-

HSA publishes Fitness for Work Guidance for Employers and Employees after COVID-19 absence

May 2021

- 27th May: ISME Note to Tánaiste re Revised Work Safety Protocol May 2021

- 26th May. Fáilte Ireland publish guidelines for re-opening cafés and restaurants available here.

- 14th May: Updated Protocol for Employers on Ventilation, Vaccinations & Antigen Testing announced – details here.

- 4th May: Applications sought from Irish-based retailers for grants of up to €40k – details here.

April 2021

- 29th April: New public health measures announced: The Path Ahead – details here.

- 23rd April: Rollout of COVID-19 vaccines in Ireland details here.

- 21st April: Applications for Phase 1 of the Small Business Assistance Scheme for COVID (SBASC) are now CLOSED. Stay tuned for more info

- 13th April: ISME released the results of our seventh flash survey on COVID-19. Read here

- 12th April: Roadmap to Re-open available here.

March 2021

- 30th March: Government announces phased easing of public health restrictions, details here.

- 26th March:Credit Guarantee Scheme will remain open for applications until end of 2021, details here.

- Applications for Phase 1 of the Small Business Assistance Scheme for COVID (SBASC) are now open. The applications should be made to your Local Authority. The closing date for receipt of applications is 21 April 2021. Click here for full information.

January 2021

- Rates due to local authorities are waived until 31 December 2020 to support businesses impacted by COVID-19. A commercial rates relief will apply for the first 3 months of 2021 for areas affected by Level 5 restrictions. There are some exceptions to this, contact your Local Authority for further details.

- The €2 billion COVID-19 Credit Guarantee Scheme that will provide an 80% guarantee on lending to SMEs has been extended until 30 June 2021, for terms between 3 months and 6 years. SMEs will be able to go directly to the banks in the Scheme, and the guarantee can be used for a range of lending products between €10,000 and €1 million that have a maximum term of 6 years or less. It will be available to all SME sectors, including primary producers. The COVID-19 Credit Guarantee Scheme is a further development of the existing Credit Guarantee Scheme which is already available from AIB, Bank of Ireland and Ulster Bank, and it will be possible for other lenders to get access to the Scheme.

December 2020

- Sunday 21st: The Government has issued a 48 hour travel ban on anyone entering the country from the UK amid concerns over a new coronavirus strain. A decision will be made as to whether or not to extend the travel ban after Tuesday’s Cabinet meeting.

- Friday 18th: Following a change to the Finance Bill, employers claiming a subsidy under the EWSS scheme must now have to show a 30% reduction in turnover will occur for the period January 1 to June 30.Read more here

- Self Employed workers can earn €960 over two months while also claiming the Pandemic Unemployment Payment (PUP). Read more here.

November 2020

- Monday 23rd: The government has published updated guidance to prevent the spread of COVID-19 in the workplace to staff. The Work Safely Protocol is a revision of the Return to Work Safely Protocol published in May 2020. The revised Protocol incorporates the current advice on the Public Health measures needed to reduce the spread of COVID-19 in the community and workplaces as issued by the National Public Health Emergency Team (NPHET), the Department of Health and Government. The main updated Public Health advice includes information on the management and control of outbreaks, selection of hand sanitisers, wearing of masks, ventilation of workplaces.

- The updated document is available for download here: https://www.gov.ie/en/publication/bb7fd-work-safely-protocol/

- On 13 October, Member States adopted the EU Recommendation on a coordinated approach to travel restrictions in the context of COVID-19. This ‘traffic lights’ approach provides for regions across the European Union (EU) and European Economic Area (EEA) (+ UK) to be categorised as green, orange, red or grey, on the basis of the risk levels associated with COVID-19.With effect from midnight 29 November 2020passengers arriving from an “orange” or “red” or “grey” region are to restrict their movements for 14 days (other than the categories outlined above). This period of restricted movement can end if the passenger receives a negative/’not detected’ result of a PCR test that has been taken a minimum of five days after arrival in Ireland. Read our advice in full here

October 2020

- In response to our appeal to stop large retailers selling non essential products that SMEs have been forced to stop selling in their shops, Business and Enterprise Minister, Leo Varadkar has stated ‘“You need to abide by the spirit of the regulations… If you are a mixed retailer, you should separate your stock and only sell items that are essential… We have been in touch with the Gardai and that will be enforced.” Read in full here

- Read the full list of Financial Government supports here

- Revenue have released a summary sheet from Budget 2021 – Available here

- Government announce CRS scheme for closed business which will give them up to €5,000 a week based on their 2019 turnover where they demonstrate that turnover has been reduced by 80% but we do need to see the T&CS. More details here

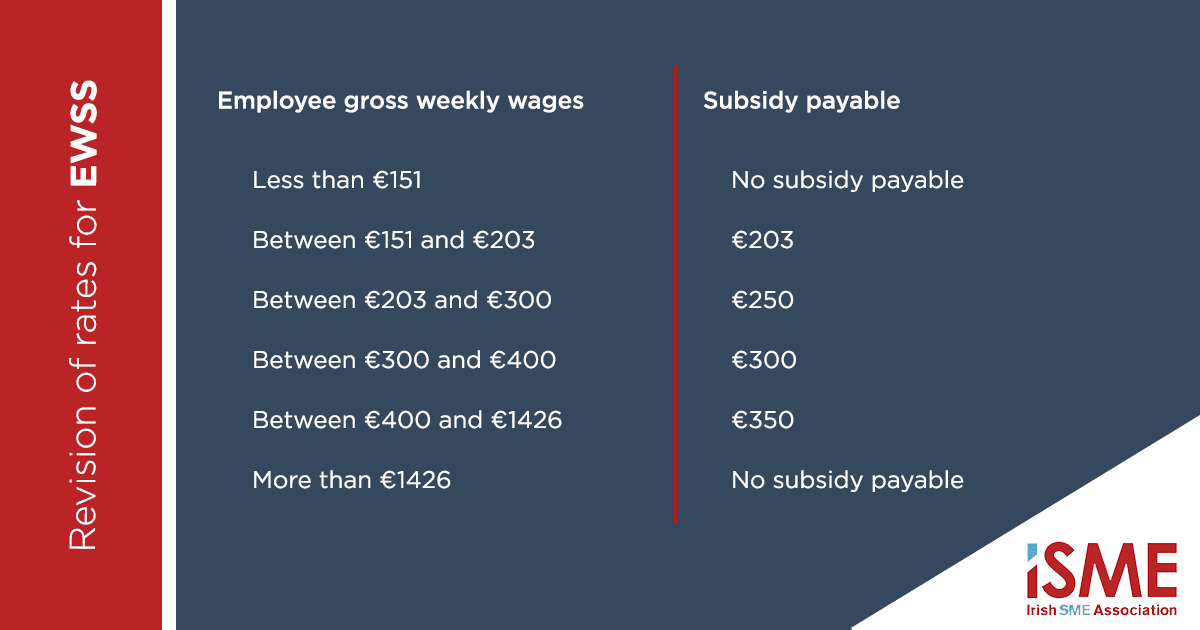

- ISME welcome the changes to the EWSS and that there is no longer a cliff edge at the end of March 2021 – instead it will continue onto the end of December 2021. See new rates belowrd

15/9/2020

The Government has announced today that:

- The Pandemic Unemployment Payment will remain open to new entrants until end-2020. This scheme was due to close to new entrants on 17th September 2020.

- The emergency suspension of section 12 of the Redundancy Payments Act is also extended until 30th November 2020. This suspends the right of employees to evoke redundancy after four consecutive weeks or six weeks in a period of thirteen of short time or temporary layoff.

- Arrangements to waive the 3 day waiting period for Jobseekers Allowance Benefit will also be extended until the end of 2020.

More information on these announcements can be found here.

10/8/2020

On 10 August 2020, new Public Health Laws made face coverings mandatory for customers in:

- Shops, including pharmacies

- Shopping centres

- Libraries

- Cinemas and cinema complexes

- Theatres

- Concert halls

- Bingo halls

- Museums

- Nail salons

- Hair salons and barbers

- Tattoo and piercing parlours

- Travel agents and tour operators

- Laundries and dry cleaners

05/08/20

The Minister for Social Protection Heather Humphreys has extended until 17 September the suspension of redundancy payments introduced in March in response to COVID-19.

These relate to when a company temporarily lays-off workers or puts them on short-time hours as a result of the impact of the pandemic. This means an employee’s right to redundancy has been deferred. It also gives the company the potential to rehire workers if business resumes.

05/08/20

The Government have announced further details on the Green List. Read in full here along with Top Tips from our HR Advisor.

24/07/20

A PDF of the July Jobs Stimulus document that was issued on Thursday 23rd can be found here. Further information available here.

23/07/20

The Government announced the Employment Wage Subsidy Scheme (EWSS) on 23rd July which will replace the Temporary Wage Subsidy Scheme (TWSS) from 1 of September 2020. The scheme provides a flat-rate subsidy to qualifying employers based on the numbers of paid and eligible employees on the employer’s payroll. It is expected to continue until 31 March 2021. Both schemes will run in parallel from 1 July 2020 until the TWSS ceases at the end of August 2020. More information on the scheme is available here.

A link containing three posters for download/print/display related to face coverings. They are available in high res for printing at this link. The posters include:

- One specifying mandatory on public transport

- One specifying that they are strongly advised in shops, and

- One is a catch-all poster suitable for many contexts and scenarios that simply says ‘please wear a face covering here’ – this has broad usage possibilities

23/07/20: Revenue have released V17 of their FAQ document on the Temporary wage subsidy scheme, available here

This update includes:

- How to report an employee commencing or ceasing employment mid scheme

- Details on how to treat employees in receipt of other payments from the department of employment affairs and social protection (DEASP)

- Details on how to treat employees who were on leave and in receipt of DEASP payments in January/February

- Reasons why a refund was not processed, or the refund was lower than expected

- Process for returning money if the refund was overpaid

22/07/20 Ireland announce ‘green list’

The Government has released the list of countries that are on Ireland’s “green list”. The 15 countries are Malta, Finland, Norway, Italy, Hungary, Estonia, Latvia, Lithuania, Cyprus, Slovakia, Greece, Greenland, Gibraltar, Monaco and San Marino.

Read our news / updates on the topic here.

Older updates

- FAQ booklet on COVID-19 Income Supports available here

- COVID-19 Workplace Protection and Improvement Guide from NSAI is available here

- Government announce list of essential services. Read in full here

- Government announce a National COVID-19 Income Support Scheme. This will provide financial support to Irish workers and companies affected by the crisis. Read Here

- Support for businesses impacted by COVID 19 through commercial rates deferral. Read here

- The latest Government announcement, addressing closures, is here

- Updates from Department of Employment Affairs and Social Protection are available here

- The most up to date Government advice is available here

- There has been an update to the Employer Refund Scheme, allowing employers engaged with the scheme to top up the payment provided by the State. Find out more here

- Minister Doherty announced details of the COVID-19 Employer Refund Scheme on 18 March, read full details here.

- Minister Humphreys announces supports for businesses impacted by COVID-19 on Wednesday 11th March 2020, read about it here.

- Recruitment: The Department of Employment Affairs and Social Protection has advised us that businesses can contact [email protected] with details of their requirements and a response can be activated centrally via Intreo offices and case officers undertaking to match existing job seekers: